2026 Study Finds Auto Insurance Is Now a Deciding Factor in the Car Deal

Polly’s 2026 Embedded Auto Insurance Study shows customers want insurance in the car buying experience, and when they get it, satisfaction and profits increase.

WILLISTON, VT, UNITED STATES, January 20, 2026 /EINPresswire.com/ -- Polly, the embedded insurance leader for automotive dealerships, released its annual embedded auto insurance study today, highlighting how insurance is increasingly shaping the customer experience during the car deal.

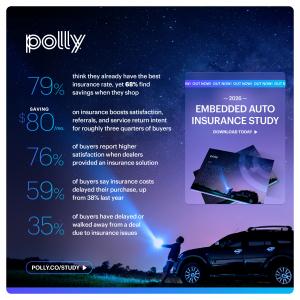

Key Findings:

• 72% of all buyers and 87% of Gen Z and Millennials want the option to compare and buy insurance while purchasing their vehicle.

• When dealers referred buyers to an insurance solution, 76% of respondents reported higher satisfaction with the car purchase experience.

• 79% of car buyers believe they have the best deal on insurance when they walk into the dealership, but 68% find savings when they shop for insurance.

• Car buyers overwhelmingly said their experience (78%), satisfaction scores (76%), likelihood to refer the dealer (78%), and likelihood to return for service (76%) would improve if they saw savings of $80 a month on insurance.

• 71% of all buyers and 82% of Gen Z and Millennials say saving about $80 per month on insurance would make them more likely to buy a nicer vehicle or protection products.

• 59% of all buyers say insurance costs delayed their purchase, up from 38% last year. Among Gen Z and Millennials, that figure rises to 68%.

• 35% of all buyers say they have walked away from or delayed a vehicle purchase because they could not secure insurance in time. That jumps to 46% for Gen Z and Millennial buyers.

A Growing Gap Between Buyer Expectations and Dealer Execution

While demand for in-dealership insurance options continues to climb, many dealers have not incorporated it into their sales process in a consistent and meaningful way. 35% of respondents noted that the dealership did nothing to support their insurance needs. Yet, when dealers engage, even minimally, by referring customers to an insurance solution, satisfaction improves. 76% of respondents noted that help from the dealership in finding an insurance solution improved their overall purchase experience.

Perception vs. Reality: Most Buyers Think They Have the Best Rate

79% of buyers say they were confident they already had the best insurance price when providing proof of insurance. Yet real-world shopping data shows a significant gap. 68% of buyers who compared insurance with Polly while at the dealership found savings.

Those savings change behavior. Buyers who save on insurance report higher satisfaction, greater willingness to spend more in the dealership, and stronger loyalty after the sale.

“Insurance is the biggest part of the buying experience dealers don’t control,” said Mike Burgiss, Chief Marketing Officer at Polly. “When dealers make insurance easier to shop for and verify, deals close faster and customers leave more satisfied with their purchase.”

-----

About the Study:

The 2026 Embedded Auto Insurance Study is based on a national survey of recent vehicle buyers conducted in 2025. The research examines how insurance costs, shopping behavior, and proof of insurance requirements affect affordability, deal velocity, and customer experience. Download the full study and methodology: www.polly.co/study

BEN JASTATT

Polly

+1 802-503-0739

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.