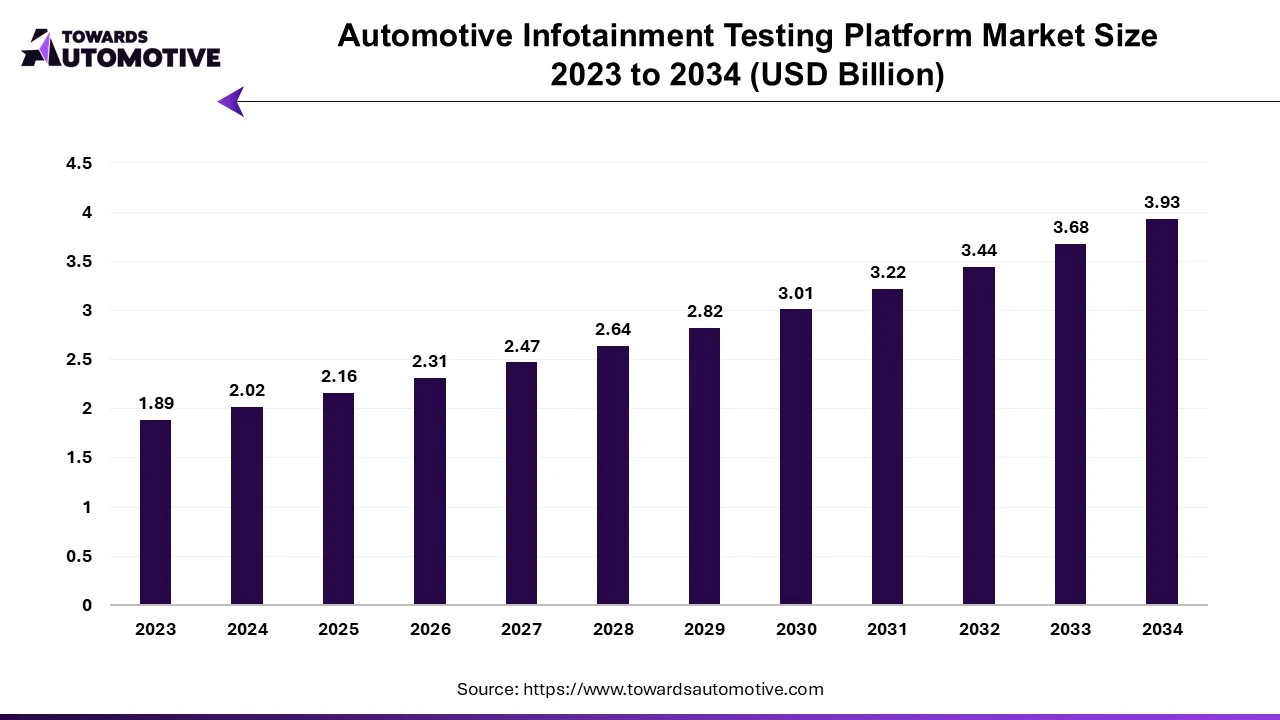

Automotive Infotainment Testing Platform Market Worth USD 3.93 Bn by 2034

According to Towards Automotive consultants, the global automotive infotainment testing platform market is projected to reach approximately USD 3.93 billion by 2034, increasing from USD 2.31 billion in 2026, at a CAGR of 6.88% during the forecast period 2025 to 2034.

Ottawa, Oct. 09, 2025 (GLOBE NEWSWIRE) -- The automotive infotainment testing platform market is projected to reach USD 3.93 billion by 2034, growing from USD 2.16 billion in 2025, at a CAGR of 6.88% during the forecast period from 2025 to 2034, according to research conducted by Towards Automotive, a sister firm of Precedence Research.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Key Takeaways

- By region, Asia Pacific dominated the market in 2024.

- By region, North America is expected to grow at the fastest rate throughout the forecast period.

- By testing type, functional testing dominated the market in 2024.

- By testing type, performance testing is the fastest growing segment.

- By platform type, cloud-based platforms led the market in 2024.

- By platform type, on-premises platforms are seen to have the fastest growth.

- By vehicle type, passenger cars segment led the market in 2024.

- By vehicle type, the commercial vehicles segment is observed to grow at the fastest rate during the forecast period.

- By infotainment system type, rear seat entertainment systems held the largest market share as of 2024.

- By infotainment system type, head-up displays are expected to grow the fastest.

What is an Infotainment Testing Platform?

Infotainment testing platforms focus on the automotive user experience by ensuring the multiple features and functions of the infotainment system work together in harmony. Infotainment testing is basically an end-to-end approach where it evaluates system and screen responsiveness as well as functional performance. This process includes testing HMI, USB, Bluetooth and Wi-Fi interoperability. It also covers routing audio channels and assesses transitions between the native infotainment HMI and Apple CarPlay or Android Auto ecosystems.

Modern infotainment systems have evolved from being high end options in luxury vehicles to now being a standard feature on all new vehicles. They are considered integral components of the connected digital cockpit, establishing a vehicle's consumer appeal in today’s day and age. As infotainment platforms grow more sophisticated with each new technology, the infotainment system testing market continues to grow even more.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardsautomotive.com/download-sample/1165

Market Outlook and Trends

- Emergence of Over-the-Air Updates: The emergence of over-the-air (OTA) updates is reshaping the automotive infotainment testing platform market. As automakers increasingly adopt OTA technology to enhance vehicle performance and user experience, the need for robust testing platforms becomes more popular.

- Rising Demand for Advanced Connectivity: The market is witnessing a surge in demand for advanced connectivity features, driven by consumer expectations for seamless integration of smartphones and other devices. As vehicles increasingly incorporate technologies such as Apple CarPlay and Android Auto, the need for rigorous testing platforms becomes a necessity.

- Increased Focus on Safety and Compliance: Governments all over the world are implementing stringent guidelines in order to ensure that infotainment systems do not distract drivers and meet safety standards. As a result, manufacturers are investing in advanced testing platforms to comply with these regulations.

- Brand and Channel Strategies: Global players are seen adopting aggressive branding and channel optimization in order to increase their visibility and reach diverse automakers. Partnerships with tier-one suppliers and testing labs are on the rise, boosting service credibility, while targeted marketing strengthens brand recognition.

Market Dynamics

Driver

Growing Adoption of Electric and Autonomous Vehicles

The growing adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is a significant driver that is impacting the global automotive infotainment testing platform market. As the automotive industry shifts towards electrification to reduce emissions and reliance on fossil fuels, the increased demand for sophisticated infotainment systems in EVs is evident.

These types of systems not only provide entertainment and connectivity features but also help in managing EV-specific functionalities such as battery status monitoring, energy consumption tracking and range estimation.

Another similar driving force is the need for the performance and functionality of advanced driver assistance systems (ADAS) and autonomous driving features. In AVs, infotainment systems play a crucial role in providing passengers with entertainment, communication and productivity options while the vehicle operates autonomously. These systems serve as an interface for interacting with AV controls and monitoring the vehicle's status, thus making their reliability and performance critical for ensuring passenger comfort, safety and trust.

Restraint

High Initial Investments

Despite strong demand drivers, the automotive infotainment testing platform market faces its fair share of challenges that may impede its growth, particularly in price-sensitive regions. High initial capital investments associated with advanced infotainment testing equipment and software licenses can prove challenging for small scale and medium scale automotive manufacturers and tier suppliers. These stakeholders often operate with constrained budgets, further limiting their access to cutting-edge validation technologies and slowing down market growth and development.

Opportunity

Integration of Artificial Intelligence

The integration of artificial intelligence into automotive infotainment systems is transforming the market and opening up new opportunities. AI technologies are now used to enhance user interaction, enabling voice recognition and personalized experiences. As automakers increasingly adopt AI to improve infotainment systems, the demand for specialized testing solutions is also expected to rise. This trend highlights how the industry adapts to the complexities introduced by AI, ensuring that infotainment systems deliver cutting edge, reliable and intuitive user experiences.

Additionally, AI-driven testing solutions offer speed and agility, enabling rapid iteration and validation of infotainment software and hardware components. Through continuous learning and refinement, AI algorithms can identify potential issues and performance bottlenecks early in the development cycle, allowing engineers to address them proactively before they turn into costly production delays. Moreover, it frees up human testers from repetitive and mundane tasks, allowing them to focus on more strategic activities such as test planning, analysis and optimization.

More Insights of Towards Automotive:

- Automotive Key Market Size to Skyrocket USD 14.94 Billion in 2034 - The global automotive key market size is calculated at USD 6.64 billion in 2024 and is expected to be worth USD 14.94 billion by 2034.

- Plug-in Hybrid Electric Vehicle (PHEV) Market to Rise by USD 193.80 Bn by 2034 - The global plug-in hybrid electric vehicle market size is calculated at USD 36.62 billion in 2024 and is expected to be worth USD 193.80 billion by 2034.

- Railway Rolling Stock Market Size to Boost USD 7.07 Billion by 2034 - The global railway rolling stock market size is calculated at USD 3.91 billion in 2024 and is expected to be worth USD 7.07 billion by 2034.

- Automotive Camshaft Market Size to Soar USD 16.34 Billion by 2034 - The global automotive camshaft market size is calculated at USD 11.14 billion in 2024 and is expected to be worth USD 16.34 billion by 2034.

- Automotive Carbon Ceramic Brake Market to Hit USD 1638.25 Million by 2034 - The global automotive carbon ceramic market size is calculated at USD 618.13 million in 2024 and is expected to be worth USD 1638.25 million by 2034.

- Automotive Performance Part Market Size to Rise by USD 664.82 Billion by 2034 - The global automotive performance part market size is calculated at USD 416.88 billion in 2024 and is expected to be worth USD 664.82 billion by 2034.

- Power Sport Accessories Market Playbook, Growth Opportunities and Trends - The power sport accessories market is projected to reach USD 14.86 billion by 2034, expanding from USD 5.28 billion in 2025.

- Apron Buses Market Size, Competitive Forces and Strategic Pathways - The apron buses market is forecast to grow at a CAGR of 26.11%, from USD 0.92 billion in 2025 to USD 7.44 billion by 2034.

- Automotive Pneumatic Actuator Market Trends and Distribution Strategies - The automotive pneumatic actuator market is forecast to grow at a CAGR of 5.44%, from USD 24 billion in 2025 to USD 38 billion by 2034.

- Automotive Glass Fiber Composites Market Growth and Market Size Analysis 2034 - The global automotive glass fiber composites market is anticipated to grow from USD 11.83 billion in 2025 to USD 16.95 billion by 2034.

- Automotive Exhaust Aftertreatment Systems Market Growth and Import & Export Analysis - The automotive exhaust aftertreatment systems market is expected to grow from USD 203.53 billion in 2025 to USD 491.41 billion by 2034.

- Automotive Telematics System Market Size, Demand and Trends Analysis 2034 - The global automotive telematics system market is expected to increase from USD 35.51 billion in 2025 to USD 54.43 billion by 2034.

- Automotive Micro Motors Market Size and Regional Production Analysis - The automotive micro motors market is forecasted to expand from USD 19.34 billion in 2025 to USD 29.45 billion by 2034.

- Off-the-Road (OTR) Tire Market Drivers, Challenges & Opportunities - The Off-the-Road (OTR) tire market is forecasted to expand from USD 18.53 billion in 2025 to USD 28.08 billion by 2034.

- Automotive Wireless Power Transmission Market Dynamics & Competitive Forces - The automotive wireless power transmission market size is set to grow from USD 14.6 billion in 2025 to USD 70.64 billion by 2034.

- Megawatt Charging System Market Challenges & Strategic Recommendations - The megawatt charging system market size is forecast to grow at a CAGR of 18.24%, from USD 909 million in 2025 to USD 4,178.04 million by 2034.

Regional Analysis

Why is Asia-Pacific dominating the market?

Asia Pacific dominated the automotive infotainment testing platform market. This dominance is driven by the increasing focus on safety and security, regulatory compliance and standards, and rising consumer expectations. As the automotive industry in the region becomes more advanced, there is a growing emphasis on ensuring that infotainment systems meet stringent safety and cybersecurity standards.

Governments in countries like Japan, South Korea and China are increasingly implementing strict regulations regarding data privacy, cybersecurity and the safe integration of infotainment systems with other vehicle technologies, thus pushing the market forward.

China Market Drivers:

- There is a growing demand for In-Vehicle connectivity and smart features. Consumers are seeking seamless smartphone integration, internet access, and personalized digital experiences.

- There is a shift toward android automotive and open-source platforms. Automakers in the region are increasingly adopting flexible operating systems that support third-party apps and OTA updates.

- There is also development of augmented reality (AR) dashboards and head-up displays (HUDs) as AR-based infotainment helps improve safety and user engagement by overlaying critical information on the windshield.

- The country is also witnessing an increase in partnerships between automakers and tech giants, which are in turn, accelerating the adoption of advanced infotainment ecosystems across vehicle segments.

What are the advancements in North America?

North America is expected to grow at the fastest rate throughout the forecast period. This growth can be attributed to the region's strong automotive industry, technological advancements and the increasing demand for advanced infotainment systems in vehicles. With stringent regulatory standards and safety requirements driving the need for comprehensive testing solutions.

Several companies in this region are investing heavily on advanced testing platforms in order to ensure the reliability and performance of infotainment systems. Additionally, the growing adoption of electric and autonomous vehicles in the region is further fueling the demand for sophisticated testing platforms

U.S Market Drivers:

- The country is witnessing an increased integration of E-Commerce and In-Car digital assistants, enabling drivers to perform tasks such as ordering food or booking services via voice commands.

- Subscription-based infotainment services and monetization models are on the rise, offering streaming, navigation, and diagnostics as monthly service bundles.

- The region is also witnessing a rise in personalized user profiles and data-driven services that allows users to save preferences and receive contextual recommendations.

- There is a rise of cloud-based infotainment systems as it allows access to real-time services such as traffic updates, streaming content as well as remote diagnostics.

Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership

Segmental Analysis

Testing Type Insights

Which testing type dominated the market in 2024?

Functional testing dominated the market in 2024. These types of systems ensure that infotainment systems operate according to specified requirements and deliver expected functionalities. This type of testing is gaining attention with the introduction of new infotainment features and functionalities, thus necessitating rigorous testing protocols to validate system performance under various conditions.

Performance testing is the fastest growing segment due to its focus on the system's ability to perform under load and stress conditions. As infotainment systems become more complex, features such as real-time data processing, multi-device connectivity and performance testing have become crucial to ensure these systems can handle high volumes of data and maintain efficiency. This testing type is witnessing rapid growth as manufacturers seek to deliver high-performing infotainment systems that offer seamless user experiences.

Platform Type Insights

Which platform type led the market this year?

Cloud-based platforms led the market this year, due to their scalability, flexibility and cost-effectiveness. These platforms enable remote testing, seamless software updates and data analytics capabilities, making them a popular choice for automotive manufacturers and service providers who are looking to optimize performance while reducing infrastructure costs. The increasing adoption of connected vehicles and over-the-air (OTA) updates further drives the demand for this segment.

On-premises platforms are expected to have the fastest growth rate as they provide greater control over testing environments, ensuring higher security and data privacy. These platforms are widely used by automakers and testing labs that require strict compliance with regulatory standards and proprietary software testing. Companies who deal with highly sensitive infotainment systems, such as those involving autonomous driving and vehicle-to-everything (V2X) communication often prefer on-premises solutions as it helps to maintain confidentiality and minimize cybersecurity risks.

Vehicle Type Insights

Which vehicle type held the largest market share?

Passenger cars held the largest market share in 2024. With consumers increasingly expecting seamless connectivity, intuitive interfaces and advanced entertainment features in their vehicles, automakers are compelled to deliver infotainment systems that meet these expectations. As a result, testing platforms tailored for passenger cars play a crucial role in ensuring the reliability, functionality and user experience of infotainment systems in these vehicles.

Commercial vehicles are seen to be the fastest growing segment as of this year. Infotainment systems in commercial vehicles serve multiple purposes, from providing entertainment and navigation for drivers to offering connectivity and safety features. Testing platforms must address the specific requirements of these vehicles, including durability, ruggedness and compatibility with specialized vehicle architectures as well as diverse terrain.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardsautomotive.com/schedule-meeting

Infotainment System Type Insights

Which Infotainment System Type dominated the market as of this year?

Rear seat entertainment systems dominated the market this year. These systems include various electronic devices such as screens, video players, gaming consoles and multimedia interfaces, allowing rear-seat passengers to enjoy movies, music and games. The demand for automotive rear seat entertainment systems is linked to the increasing popularity of premium and luxury vehicles that offer a wide range of in-car experiences. With innovations like high-definition screens, wireless connectivity, and streaming capabilities, this segment is becoming an essential feature in more and more vehicles.

The heads-up display segment is expected to have the highest growth rate over the forecast period. This growth can be attributed to the increasing application of augmented reality technology. With the usage of AR, real-time information such as speed, arrow indicators and warning signals can easily be displayed and analyzed, thus making them widely preferred by automobile customers worldwide.

Automotive Infotainment Testing Market Top Vendors and their Offerings

- Rohde & Schwarz has established itself as a pivotal player in the automotive infotainment testing platform market with its innovative test and measurement technologies. Known for its precise signal analysis and simulation tools, the company has empowered automotive OEMs and Tier 1 suppliers to validate infotainment functionalities, connectivity, and compliance with global standards.

- National Instruments (NI), based in the United States, plays a crucial role in shaping The Automotive Infotainment Testing Platform Market with its software-centric, modular instrumentation solutions. NI’s approach integrates LabVIEW, TestStand, and PXI hardware systems to streamline testing processes and reduce time-to-market. Their platforms support comprehensive infotainment system validation, from GPS and media playback to Bluetooth and wireless charging functionality.

- Keysight Technologies is a global leader providing end-to-end testing solutions that address the complex needs of modern automotive infotainment systems. From signal integrity analysis and audio quality testing to electromagnetic compatibility (EMC) and compliance verification, Keysight’s tools offer unmatched precision. Their solutions are widely adopted across the automotive supply chain, enabling manufacturers to simulate real-world operating conditions and validate seamless connectivity.

- Aptiv PLC: Aptiv is a leading global technology company who provides innovative testing solutions for automotive infotainment systems, particularly those involved in connected car technologies. Aptiv’s testing platforms focus on the integration of infotainment systems with other advanced technologies, such as autonomous driving systems and V2X communication.

-

Vector Informatik: Vector Informatik provides comprehensive testing and simulation solutions, especially for networking and communication within infotainment systems. Their platforms are widely used for testing the interoperability of infotainment systems with other car components, such as ADAS (Advanced Driver Assistance Systems) and the vehicle's internal communication network.

Access our exclusive, data-rich dashboard dedicated to the Automotive Infotainment Testing Market designed specifically for decision-makers, strategists, and industry leaders. Towards Automotive dashboard offers in-depth statistical insights, segment-wise market analysis, regional share breakdowns, comprehensive company profiles, annual updates, and much more. From market sizing to competitive benchmarking, this all-in-one platform is your strategic gateway to smarter, data-driven decisions.

Access Now: https://www.towardsautomotive.com/contact-us

Automotive Infotainment Testing Market Top Key Players

- IHS Markit

- J.D. Power

- NI (National Instruments)

- TestEquity

- Divergent Technologies

- Anritsu

- JD Noveli

- VSI Labs

- Intertek

- Keysight Technologies

- Auriga Technologies

- Spirent Communications

- Vector Informatik

- PCTEST Engineering Laboratory

- Rohde Schwarz

Recent Developments

- In July 2025, Tata Technologies has announced a global partnership with Emerson to develop cutting-edge, integrated testing and validation solutions tailored for next-generation mobility. This collaboration is designed to address the increasing complexity in electric, connected, and autonomous vehicles by combining Tata Technologies’ prowess in systems and Emerson’s test and measurement automation capabilities. Together, the two companies aim to reduce product development timelines and costs, enabling faster time-to-market for advanced mobility solutions.

- In September 2025, Qualcomm Technologies and BMW Group have announced Snapdragon Ride Pilot, an automated driving (AD) system built on Qualcomm’s Snapdragon Ride system-on-chips and a new Snapdragon Ride AD software stack co-developed by both companies. The system has made its production debut in the all-new BMW iX3, which is a part of BMW’s Neue Klasse platform, and has also been validated for use in more than 60 countries.

Segments Covered in the Report

By Testing Type

- Functional Testing

- Performance Testing

- Security Testing

- Compatibility Testing

By Platform Type

- Cloud-based Platforms

- On-premises Platforms

- Hybrid Platforms

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Luxury Vehicles

- Electric Vehicles

By Infotainment System Type

- Head-up Displays

- Digital Instrument Clusters

- Infotainment Screens

- Rear Seat Entertainment Systems

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East and Africa

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/price/1165

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardsautomotive.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardsautomotive.com

About Us

Towards Automotive is a leading research and consulting firm specializing in the global automotive industry. We deliver actionable insights across key segments such as electric vehicles (EVs), autonomous driving, connected cars, automotive software, aftermarket services, and more. Our expert team supports both global enterprises and start-ups with tailored research on market trends, technology, and consumer behavior. With a focus on accuracy and innovation, we empower clients to make informed decisions and stay competitive in a rapidly evolving landscape.

Stay Connected with Towards Automotive:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards AutoTech

- Read Our Printed Chronicle: Automotive Web Wire

- Visit Towards Automotive for In-depth Market Insights: Towards Automotive

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

- Get ahead of the trends – follow us for exclusive insights and industry updates: Tumbler | Bloglovin | Medium | Hashnode | Pinterest

Towards Automotive Releases Its Latest Insight - Check It Out:

- Automotive Thermoplastic Polymer Composites Market Growth

- Motorcycle Helmet Cameras Market Analysis

- Automotive Mudguards Market Consumer Behavior

- Automotive Chip Market Size, Innovations & Dynamics

- Automotive Radiator Market Size and Production Forecast 2034

- Aerospace DC-DC Converter Market Size, Supply Chain & Logistics Data

- Automotive Electric Vacuum Pump Market Size and Growth

- Automotive Cabin Insulation Market Size, Growth and Shares

- Military Vehicle Sustainment Market Size and Quick Updates

- Automotive HVAC System Market to Surge USD 104.92 Bn by 2034

- Aerostat System Market Size to Expand USD 54.52 Bn by 2034

- Small Boats Market Growth Drivers, Challenges and Opportunities

- Automotive Composite Liftgate Market to Ascend $3.28 Bn by 2034

- Automotive Body-in-White Market Size Hit to $133.09 Bn by 2034

-

Electric Excavators Market Size to Scale $340.88 Bn by 2034

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.