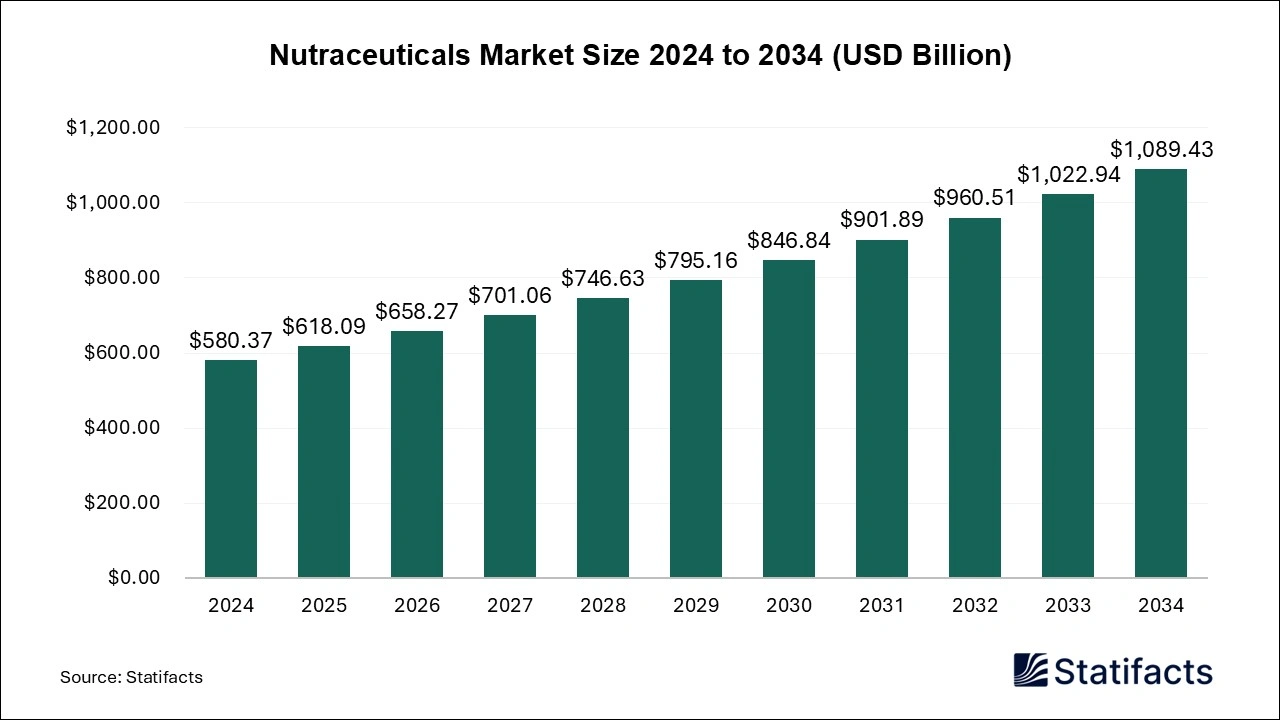

Nutraceuticals Market Size is Forecast to Reach USD 1,089.43 Billion by 2034 Rising Demand for Preventive Health and Natural Supplements

The global nutraceuticals market size is projected to grow significantly, reaching USD 1,089.43 billion by 2034 up from USD 618.09 billion in 2025, reflecting a CAGR of 6.5% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Aug. 01, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global nutraceuticals market size was evaluated at USD 580.37 billion in 2024 and is anticipated to reach around USD 1,089.43 billion by 2034, expanding at a CAGR of 6.5% from 2024 to 2034. Increasing senior population, increasing use of dietary supplements, growing awareness of nutraceuticals products, rising prevalence of metabolic disorders, and the rise of the e-commerce industry contribute to the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8206

Nutraceuticals Market Highlights

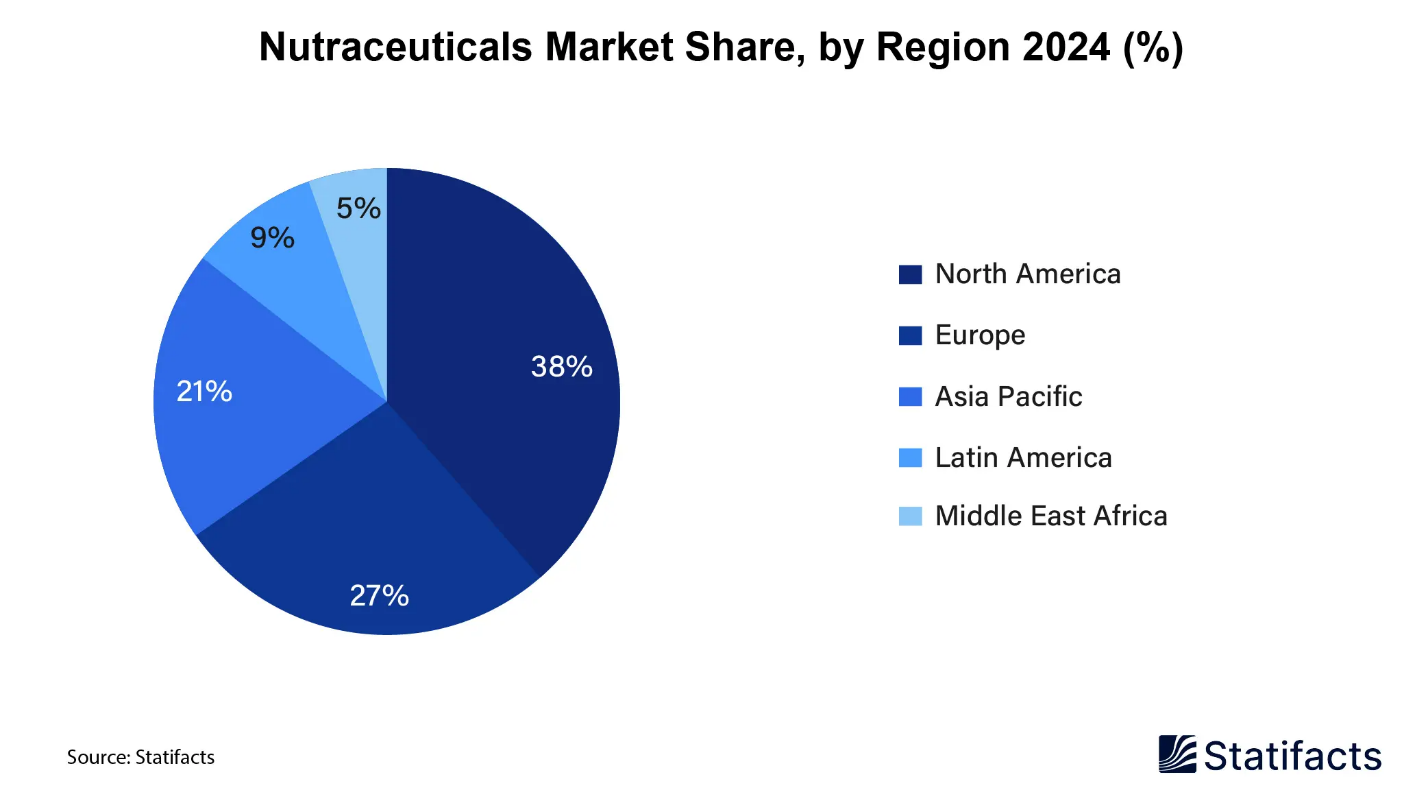

- North America has accounted highest revenue share of 38% in 2024.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By type, the functional food segment held a dominant presence in the market share of 46% in 2024.

- By type, the dietary supplements segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By form, the tablets segment accounted for a considerable share of the market in 2024.

- By form, the liquid & gummies segment is expected to grow at the fastest rate in the market during the forecast periods.

- By sales channel, the offline segment led the global nutraceuticals market Share of 33% in 2024.

- By sales channel, the online segment is set to experience the fastest rate of market growth from 2025 to 2034.

Nutraceuticals Market Size, by Type, 2023-2026 (USD Billion)

| Segments | 2023 | 2024 | 2025 | 2026 |

| Dietary Supplements | 134.11 | 141.03 | 150.01 | 156.82 |

| Functional Foods | 246.96 | 267.28 | 288.48 | 310.50 |

| Functional Beverages | 157.81 | 172.04 | 187.71 | 204.96 |

Nutraceuticals Market Size, by Region 2023-2026 (USD Billion)

| Segments | 2023 | 2024 | 2025 | 2026 |

| North America | 194.64 | 206.93 | 220.39 | 233.50 |

| Europe | 133.88 | 144.91 | 157.15 | 169.57 |

| Asia Pacific | 107.31 | 116.73 | 127.19 | 137.89 |

| Latin America | 68.47 | 74.28 | 80.74 | 87.31 |

| Middle East & Africa | 34.58 | 37.49 | 40.72 | 44.01 |

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Nutraceuticals Market Overview

The nutraceuticals market refers to the production, distribution, and use of nutraceuticals, which is a broad umbrella term that is used to describe any product derived from food sources with extra health benefits. Nutraceuticals are also defined as ‘a functional food that aids in the prevention and treatment of diseases and other disorders.’ The benefits of nutraceuticals include supporting reproductive health, managing psychological function, improving athletic performance, slowing down aging, boosting gut health, reducing inflammation, improving the functioning of the immune system, and preventing and treating chronic disease.

Increasing use of dietary supplements, rising senior population, rising number of fitness centers, rising prevalence of lifestyle-related diseases, constant advancements, growing awareness regarding health and well-being, and rising need for preventive healthcare are driving the growth of the nutraceuticals market.

Major Trends in the Nutraceuticals Market

What Principal Factors Shape the Nutraceuticals Industry?

Rising use of dietary supplements and rising awareness of nutraceutical products are principal factors that shape the nutraceuticals industry.

- Rising use of dietary supplements: Dietary supplements can improve overall health and help manage some health conditions. Dietary supplements offer higher vitality, improve memory, and contribute to maintaining the health of the skin, hair, and nails. The reasons for taking supplements include aging, chronic health conditions, diet, pregnancy, and weight loss. Some dietary supplements can improve overall health and help manage some health conditions. A well-balanced diet provides all of energy we need to keep active throughout the day, nutrients needed for growth & repair, helping us to stay strong and healthy, and helps to prevent diet-related illness.

- Rising awareness of nutraceutical products: Nutraceuticals are not only used for nutrition but also as a support therapy for the prevention and treatment of many diseases. Research has shown that nutraceuticals foster mental well-being, fight oxidative stress, improve sleep quality, and ease migraines. Nutraceuticals can also augment cognitive function, aid in the management of neurodegenerative diseases, and lower pain and weight.

Growth Factors in the Nutraceuticals Market

- Increasing prevalence of metabolic disorders: Nutraceuticals in metabolic disorders act as a substitute for pharmaceutical drugs. They play a supportive role in preventive healthcare, especially in addressing conditions frequently associated with metabolic syndrome, like heart disease, stroke, type 2 diabetes, and various cardiovascular issues. Research shows that nutraceuticals play an important role in energy metabolism; they are required as functional parts of enzymes involved in energy release and storage. Vitamin-based nutraceuticals are important for many metabolic processes, including collagen formation. Collagen is used in different ways throughout the body. Its primary role is to strengthen the skin, bone, and blood vessels.

- Shift towards preventive healthcare: Nutraceuticals are medicinal foods that play a role in modulating immunity, improving health, maintaining well-being, and thereby preventing as well as treating specific diseases. The significance of nutrition in preventive healthcare includes a balanced diet that not only provides essential nutrients but also bolsters the immune system, fortifying the body against diseases and infections. Preventive healthcare Preventive healthcare is a vital aspect of promoting overall health and wellness. Preventive healthcare focuses on reducing the risk of illness through lifestyle changes, early detection, and other proactive measures.

Case Study: Care/of - Personalized Nutrition in E-Commerce

Care/of is a leading brand in personalized nutrition that offers tailored vitamin and supplement packs to consumers based on their individual health goals and lifestyle preferences. This aligns with the growing trend in the nutraceuticals market, where consumers are increasingly seeking personalized, wellness-focused solutions. Care/of operates through an e-commerce platform, offering a seamless online experience for customers.

Challenge:

Care/of faced the challenge of standing out in a crowded market of nutraceutical products, many of which are sold through traditional retail channels. The primary challenge was building trust with consumers who were skeptical about the effectiveness of dietary supplements and needed guidance on which products would best support their specific health needs.

Strategy:

- Personalized Health Assessments: Care/of uses a detailed quiz to assess customers' health goals, lifestyle habits, and dietary preferences. This information is used to recommend a tailored supplement plan that matches their individual needs.

- Subscription Model: By offering a subscription service, Care/of ensures that customers receive their personalized supplements delivered directly to their doorsteps on a regular basis, which enhances convenience and fosters customer loyalty.

- Transparency and Education: The brand emphasizes transparency, providing clear information about the sourcing of ingredients, their benefits, and how they contribute to overall wellness. This builds trust and educates consumers on the importance of personalized nutrition.

- Digital Marketing: Care/of utilizes targeted online marketing strategies, including influencer partnerships and digital ads, to reach health-conscious consumers. The e-commerce platform is optimized to make the purchasing process smooth and easy.

Results:

- Increased Consumer Engagement: The personalized approach led to higher customer satisfaction, with many customers returning for repeat purchases. The detailed health assessments and tailored products helped increase the brand's credibility.

- Revenue Growth: The subscription model provided steady revenue streams and increased customer lifetime value as consumers were more likely to continue their subscriptions over time.

-

Market Differentiation: Care/of differentiated itself from competitors by offering a high level of personalization and a seamless online shopping experience. This helped them carve out a niche in the growing nutraceuticals market.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8206

Role of Artificial Intelligence (AI) in Nutraceuticals Market

Artificial intelligence (AI) is transforming the nutraceuticals industry. AI can analyze a person’s health data and suggest the best nutraceuticals for them. Many AI methods have significantly advanced accurate nutrition research, playing an important role in uncovering new health patterns from patient data, developing personalized recommendation systems, and creating healthcare management systems. AI can automatically inspect printed parts for defects using machine learning algorithms, ensuring high-quality output. Additionally, AI can also help to maintain consistency in production, which is important for mass production and critical applications. AI aids in the development of new materials for additive manufacturing.

AI can help functional ingredients and dietary supplement providers create successful formulations, improve clinical studies, and personalize nutritional offerings. AI integration allows for predictive bio-actives with prespecified health benefits and subsequent selection of the most suitable source, which contains an abundance of these bio-actives, plus bioactivity confirmation.

What are the Significant Achievements of the Leading Nutraceuticals Industries?

- In June 2025, digital-first wellness brand ‘Siens’ in its nutraceuticals foray was launched by Foray. The product lineup features Marine Collagen, 3 in 1 Hair, Skin, & Nails Gummies, multivitamins for both men and women, Omega-3 softgels, and daily pre- and probiotics.

Source: CNBC TV 18

- In February 2025, Dealsphere, a game-changing platform designed to revolutionize how businesses discover, license, and commercialize science-backed nutrition products, was launched by Nutrify Today, a trailblazer in AI-driven nutraceutical advancements. This innovative marketplace simplifies the traditionally complex and time-consuming product development process, allowing companies to launch new nutraceutical offerings in just days.

Source: EHealth

How IoT acts as an Opportunity for the Nutraceuticals Market?

The Internet of Things (IoT) offers many benefits, including improved data analysis, cost savings, and increased efficiency. It allows automation, improves communication, and provides valuable insights for better decision-making in many sectors. IoT technologies provide scalable and personalized nutrition education for patients and healthcare providers. In pharmaceutical manufacturing, IoT devices can be used to monitor critical parameters like temperature and humidity, ensuring product quality and safety. IoT devices can also be used to track products throughout the supply chain, providing real-time visibility and allowing timely interventions in quality issue cases. IoT helps to easily monitor the state of all food products and send real-time information to the handler, thereby decreasing food wastage.

IoT technologies allow manufacturers to enhance productivity by automating processes, improving capacity planning, and implementing predictive maintenance activities. IoT, like equipment tracking systems, can assist healthcare businesses in lowering costs. It helps to give patients tailored treatment, therefore boosting the quality of healthcare services.

Limitations and Challenges in the Nutraceuticals Market

What are the Potential Concerns Related to the Nutraceuticals Market?

The threat of fake dietary supplements and a challenging regulatory environment are the potential concerns related to the nutraceuticals market.

- The threat of fake dietary supplements: Some supplements can cause problems if taken along with specific medicines. Antioxidants like vitamin E and C may make some chemotherapy medicines less effective. Fake dietary supplements may contain improper dosing and contaminants that may place patients at direct risk. Specific supplements can increase the potential for internal bleeding, reduce the effectiveness of medications, or cause psychological changes that can harm the body.

- Challenging regulatory environment: A major issue in regulatory compliance is that information may be scattered. It may also include a lack of awareness and understanding of environmental regulations among the public and even within specific sectors of industry. Disadvantages of the regulatory environment include slowed competitiveness, negative effect on small businesses, regulating activities can be costly, and complexity can hinder the growth of the market.

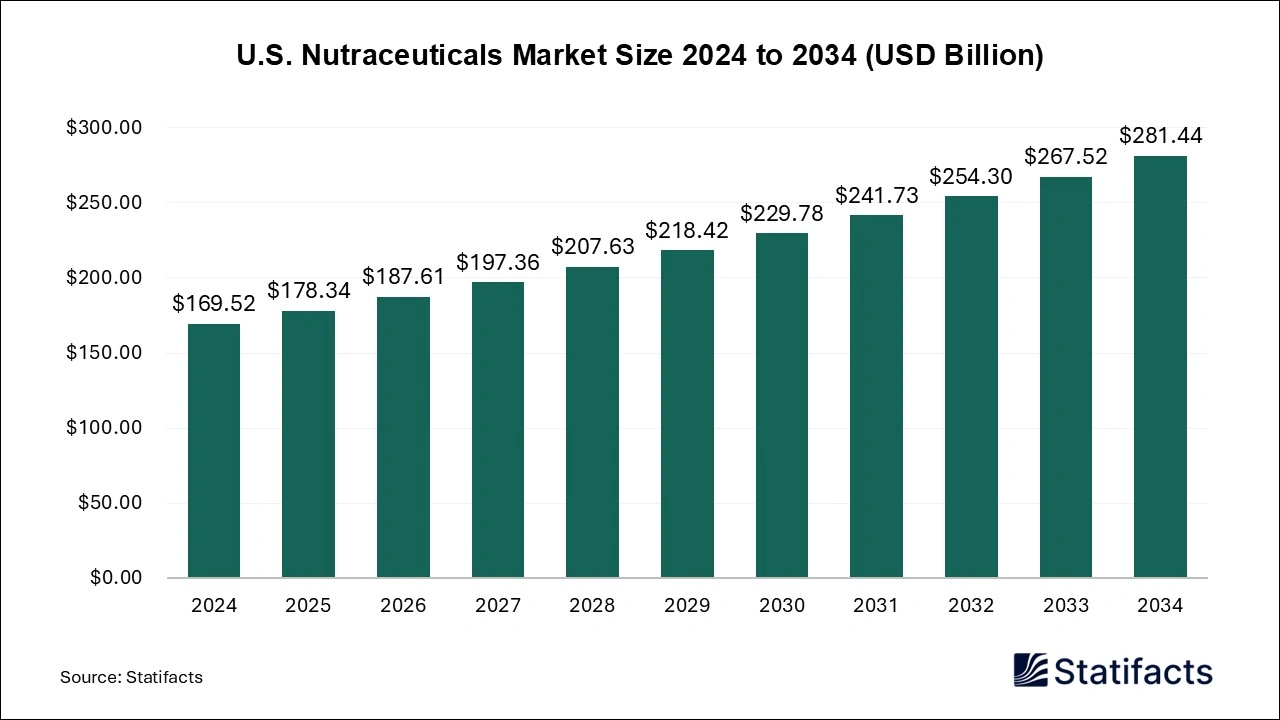

U.S. Nutraceuticals Market Size 2024 to 2034 (USD Billion)

The U.S. nutraceuticals market size is calculated at USD 169.52 billion in 2024 and is predicted to reach around USD 281.44 billion by 2034, expanding at a CAGR of 5.2% from 2025 to 2034.

How did North America Dominate the Nutraceuticals Market?

North America dominated the global nutraceuticals market in 2024. Increasing use of dietary supplements, rising senior population, rising awareness of nutraceuticals products, and rising prevalence of metabolic disorders are driving the growth of the market in North America.

How do Nutraceuticals Act as a key to the Nutraceuticals Industry in the United States?

- In January 2025, the launch of premium NSF Certified for Sport® nutraceutical line of products, Spoken Nutrition, was announced by Cizzle Brands Corporation, the sports nutrition company elevating the game in the health and wellness. Spoken’s line of products is composed of nutritional supplements formulated by the world’s leading performance coaches, dieticians, nutritionists, and functional medicine doctors to meet the needs of their professional athletes.

Source: Business Wire

What to Expect from the Nutraceuticals Market in India, China, and Asia Pacific?

Asia Pacific is projected to host the fastest-growing market in the coming years. Infrastructure development, technological advancements, increasing consumer demand, advancements in big data analytics, increasing smartphone penetration, and rapid adoption of cloud-based technology are contributing to the growth of the nutraceuticals market in the Asia Pacific region.

How Do Nutraceuticals Act as a Key to the Nutraceuticals Industry in India?

- In July 2025, the nutraceutical trade expo 2025 ‘Bharat Nutraverse’ was launched by India. The event comes as India’s nutraceutical industry continues to grow rapid. In 2015, the market was worth US$2 billion, and by 2025, it is expected to reach over US$22 billion.

Source: Indian Pharma Post

Nutraceuticals Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 580.37 Billion | |

| Market Size in 2025 | USD 618.09 Billion | |

| Market Size in 2030 | USD 846.84 Billion | |

| Market Size in 2032 | USD 960.51 Billion | |

| Market Size by 2034 | USD 1,089.43 Billion | |

| CAGR 2025-2034 | 6.5% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia-Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Type, By Form, By Sales Channel, By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | Dietary supplements Archer Daniels Midland Company, General Mills, Inc., du Pont de Nemours and Company, Aland (Jiangsu) Nutraceuticals Co., Ltd., BASF SE, Cargill, Incorporated, Royal DSM N.V., Groupe Danone S.A., Nestle S.A., PepsiCo Inc., and Others. | |

Become a valued research partner with us - https://www.statifacts.com/schedule-meeting

Nutraceuticals Market Segmentation Analysis

Type Analysis

The functional foods segment held a dominant presence in the nutraceuticals market in 2024. Functional foods contain nutrients and compounds that offer significant health benefits. They may support our blood sugar control, heart health, immune system, and more. Functional foods play an important role in maintaining a healthy lifestyle and reducing the risk factors of many diseases. Many foods have a functional element that is responsible for improving the healthy state.

The dietary supplements segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Dietary supplements are products like herbs, minerals, and vitamins that claim to promote wellness. Dietary supplements can be a great source of nutrients. They can help improve overall health and may reduce the risk of some health conditions.

Form Analysis

The tablets segment accounted for a considerable share of the nutraceuticals market in 2024. Nutraceutical tablets are a mix of the benefits of both food and medicine. Natural ingredients like herbs, minerals, vitamins, or other beneficial nutrients form their composition. The benefits of using nutraceutical tablets include filling nutrient gaps, supporting heart health, boosting energy levels, improving digestion, strengthening bones, boosting the immune system, and providing extra nutrients.

The liquid & gummies segment in the nutraceuticals market is expected to grow at the fastest rate during the forecast period due to a shift in consumer preference towards convenience and innovation in delivery mechanisms of the vitamins, minerals, and other supplements. Compared to hard tablets, gummies and liquids are easier to chew and swallow. This is especially useful for the elderly, children, as well as those adults averse to pills. Compared to tablets, gummies also usually have flavor enhancements that mask the bitter or chalky taste of some of the ingredients. Liquids are also absorbed a lot faster by the body. Apart from these benefits, younger demographics often prefer the candy-like appeal of gummies. Many gummies are now made with gelatin-free, vegan, and allergen-free formulations, catering to the growing demand for clean-label products.

Sales Channel Analysis

Offline segment led the nutraceuticals market. Offline sales channel for nutraceuticals benefits include tangible experience, personalized customer service, lower costs, improved data insights, builds relationships when networking, better inventory management, personal interaction, easier to retain loyal customers, and improved brand loyalty. It also includes benefits like we can actually experience the product, and no need to wait for the delivery.

The online segment is projected to experience the highest growth rate in the market between 2025 and 2034. The benefits of online sales channels for nutraceuticals include affordable advertising & marketing, affordable, access to global markets, selling products globally, security risks, promotional tools for product marketing, increased profitability, flexible payment options, direct customer relationship, creating brand awareness, lower costs, and lower operating costs.

Browse More Research Reports:

- The U.S. human nutrition market size surpassed USD 115.57 billion in 2024 and is predicted to reach around USD 208.76 billion by 2034, registering a CAGR of 6.09% from 2025 to 2034.

- The global nutraceutical packaging market size is worth around USD 9,120 million in 2024 and is anticipated to reach around USD 15,285 million by 2034, growing at a CAGR of 5.3% from 2024 to 2034.

- The global A2 milk market size was evaluated at USD 4.36 billion in 2024 and is expected to grow around USD 14.16 billion by 2034, registering a CAGR of 12.5% from 2025 to 2034.

- The U.S. dietary supplements market size was calculated at USD 48.74 billion in 2024 and is predicted to attain around USD 104.88 billion by 2034, expanding at a CAGR of 7.96% from 2025 to 2034.

- The global human nutrition market size was calculated at USD 452.92 billion in 2024 and is predicted to attain around USD 838.21 billion by 2034, expanding at a CAGR of 6.34% from 2025 to 2034.

- The global protein supplements market size was calculated at USD 6,900 million in 2024 and is predicted to reach around USD 15,030 million by 2034, expanding at a CAGR of 8.1% from 2025 to 2034.

- The global personalized nutrition and supplements market size was evaluated at USD 14,040 million in 2024 and is expected to grow around USD 55,090 million by 2034, registering a CAGR of 14.65% from 2025 to 2034.

- The global nutritional yeast market size is calculated at USD 262 million in 2024 and is predicted to attain around USD 913.27 million by 2034, expanding at a CAGR of 13.3% from 2024 to 2034.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8206

Competitive Landscape in the Nutraceuticals Market

- Archer Daniels Midland Company

- General Mills, Inc.

- du Pont de Nemours and Company

- Aland (Jiangsu) Nutraceuticals Co., Ltd.

- BASF SE

- Cargill, Incorporated

- Royal DSM N.V.

- Groupe Danone S.A.

- Nestle S.A.

- PepsiCo Inc.

What is Going Around the Globe in the Nutraceutical Ma?

- In June 2025, Siens, a direct-to-consumer supplement brand that focuses on beauty, gut health, and wellness as it expands into the digital nutraceutical space, was introduced by Dabur India. Notable offerings of Siens include Marine Collagen, 3 in 1 Hair, Skin, and Nails Gummies, and multivitamins for men and women, Omega-3 softgels, and a daily pre- and probiotic supplement.

Source: Best Media Info

- In December 2024, to launch specialty nutraceuticals, Akums Drugs & Pharmaceuticals Ltd., India’s largest contract development and manufacturing organization (CDMO), entered into an in-licensing agreement with Caregen Co., Ltd., a global biotechnology leader based in South Korea. This strategic alliance marks a significant step in introducing specialty nutraceuticals, pharmaceuticals, differentiated topical and injectable cosmeceuticals, including advanced Skinceuticals and Hairceuticals tailored to meet the unique needs of Indian consumers.

Source: Nuffoods Spectrum

Nutraceuticals Market Segments Covered in the Report

By Type

- Dietary Supplements

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Others

- Functional Beverages

- Energy Drinks

- Sports Drinks

- Functional Juices

- Others

- Functional Food

- Carotenoids

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Vitamins

- Others

By Form

- Tablets

- Hard Capsules

- Soft Capsules

- Oil

- Powder

- Others

By Sales Channel

- Offline

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Online Retail Stores

- Other

- Online

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.